dHEDGE Community Newsletter #2

Welcome to the dHEDGE Monthly Community Newsletter. In this publication we will outline all the news, product release, media, growth stats, upcoming events and much more!

News

In recent weeks, the market has experienced intense volatility. Fear amongst investors started to emerge following negative news out of China (strict rules on Bitcoin mining) and some energy concerns shared by Elon Musk, leading Tesla to stop accepting Bitcoin payment.

From May 18th onwards, the market has seen steep declines, with record 1-day losses all across the board, showing once again how volatile Crypto assets can be. The steep decline has left investors wondering, is this the end of the Bull market? Yet on May 23rd, the market started to pick up again with 2 digits gains and strong upwards momentum. While it’s not sure if this is the end of this bull market, the coming months will be intense and likely volatile.

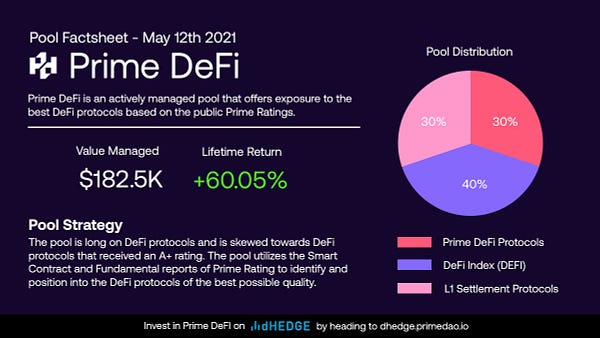

You can save yourself the stress and effort of monitoring the market 24/7 by exploring one of the dHEDGE pools operated by top crypto asset managers, but you already knew that, of course!

dHEDGE Top Index - dTOP update

The dTOP index weights have been rebalanced for June! Each Month dTOP rebalances into the new top 10 from the dHEDGE leaderboard.

Weights are as follows:

Jesse Livermore Hearts Crypto / @JLHeartsCrypto - 24.96%

Convex Strategies / @ConvexMonster - 16.59%

YANG(That Asian Quant) / @Wangarian1 - 10.73%

Guttastemning / @GuttaCap - 8.37%

A-DAM Public Fund / @A_DAMcapital - 7.17%

Potato_Swap / @GuntisVitolins - 6.79%

Synthetix Community Pool / @rubberducketh - 6.70%

Alpha+Omega Fund(AOF) / @FundOmega - 6.59%

Black Lion Fund(BLF) / @liondani - 6.46%

Alchemy Fund / @AlchemyFund - 6.40%

In its second month, the dTOP Index made around $17k in performance fees for its managers!

dTOP currently has almost $3.5M value managed!

Exciting news with our dHEDGE V2 roadmap! Lots of exciting new features including new assets, new chains and yield farming opportunities.

5 DAOs investing in dHEDGE

The following trailblazing DAOs have all committed to invest part of their treasury on the dHEDGE platform starting now:

mStable: $200,000

Horizon Finance: $100,000

Maple Finance: $100,000

InsurAce: $50,000

Perpetual Protocol: $200,000

Alpha Insights with dHEDGE top managers, an awesome interview with Jesse Livermore and ioBots Pro. Next issue shortly!

dHEDGE V2 Updates

The sUSD/DHT Uniswap LP incentives have finished. We now have new liquidity mining pools for DHT and dTOP on SushiSwap Polygon and With TRIPLE rewards available! Check out the Medium article.

New Audit booked with Certik, due to be completed within the next few weeks!

Developer Updates

Polygon Mumbai testnet integrated for dHEDGE V2, final internal testing underway!

EcoDAO Updates

As an example for DAO treasury management we have allocated $35k from EcoDAO treasury into dTOP.

Proposed review of EcoDAO councilors monthly reward, using a combination of DHT and dTOP as rewards. We will have further discussion in discord and on the forum before submitting a formal proposal to the dHEDGE DAO for a snapshot vote.

Growth stats

Total Value Locked

Total Trading Volume over $550M!!

dHEDGE in the Media

Great article from Cryptodaily about the DAOs investing in dHEDGE.

Fantastic dHEDGE and DHT analysis by @jarysmora

Interesting Tweets

Make sure you follow @dHedgeBot for instant network updates including trades, deposits and more!

Upcoming Events

EcoDAO Community call on the 22nd June UTC 1am, AEST 11am, Zoom invite link.

Come work with us!

We are on the lookout for an amazing and creative Lead UX/UI Designer. Apply directly on LinkedIn.

Become a community contributor and help grow dHEDGE! Please join our Discord and let us know!

Thank you for reading.