Welcome to the dHEDGE Monthly community newsletter. In this publication we will outline all the news, developer updates, media, upcoming events and much more!

GM! Very interesting times with all the L2 scaling solutions ramping up. Users now have plenty of options for utilizing all the DeFi applications.

dHEDGE V2 interest has been rising steadily and has over $2M AUM in only 6 weeks! With more features and protocol integrations we should see significant increase over the coming weeks.

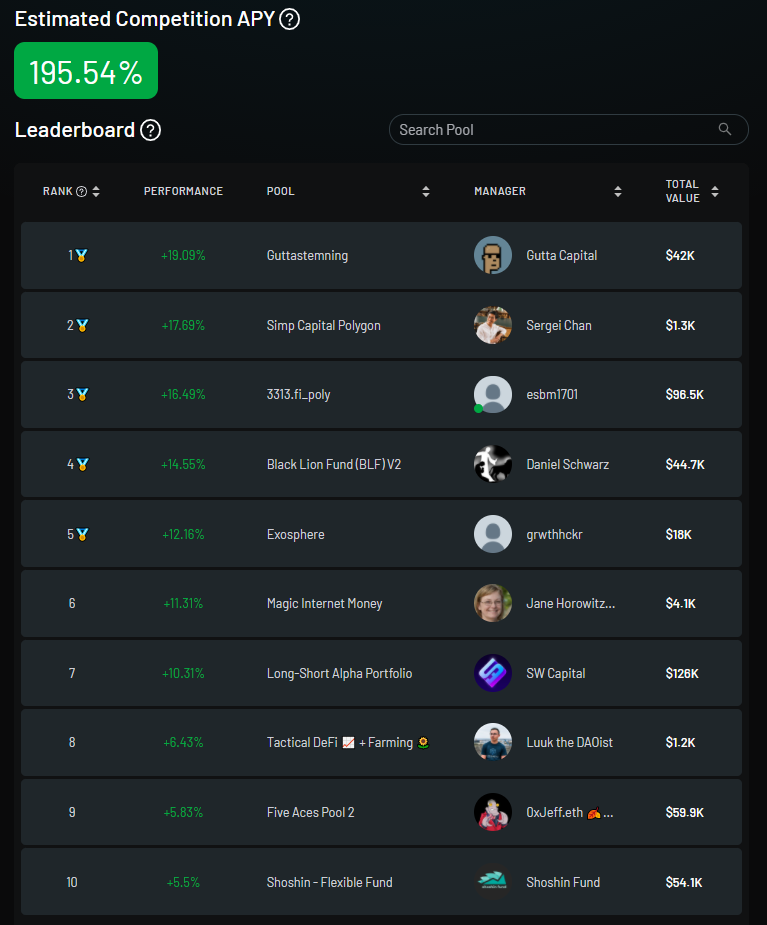

Trading Competition

Our epic sushi fest has concluded. Great performance from all managers! Tremendous to see managers highlighting the features of dHEDGE V2. Utilizing the cheap gas to make multiple trades on short time frames.

Congratulations to the winning pools!

The winning 5 pools are:

1st - Guttastemning - Gutta Capital

2nd - Simp Capital Polygon - Sergei Chan

3rd - 3313.fi_poly - esbm1701

4th - Black Lion Fund(BLF)V2 - Daniel Schwarz

5th - Exosphere - grwthhckk

Shoutout goes to Alexander Markl of SW Capital! Was in the top 2 for most of the competition but just missed out!

All investors from the winning pools will shortly receive their initial prize amount.

The second part of the prize is vested for 2 months and awarded to investors still invested in their winning pool.

If an investor withdraws from their winning pool, they are no longer eligible to receive this vested payment associated with that pool.

New Governance Process

In an exciting change, we have a formal process for all governance proposals increasing transparency and decentralization. Indicated here by DMP-1, DMP-2 and DMP-3.

In summary the 3 types of proposals are:

dHEDGE Meta Proposals (DMPs) are suggested changes to the governance process. The purpose of this category is to make governance self-correcting, and changes to the governance process transparent.

dHEDGE Feature Proposals (DFPs) are how token holders decide which features are included in the dHEDGE platform. This makes the roadmap more decentralized.

dHEDGE Capital Proposals (DCPs) are how token holders decide how large capital allocations are made. Examples include rebalancing and distribution of fees collected by the protocol and capital allocations to the grants DAO.

All proposals need to be put up for discussion on the dHEDGE forum. After discussion the proposal can then be put up for vote via snapshot.

Proposals passed

Proposals up for discussion

Balancer grant

dHEDGE has been approved for a grant from Balancer. This grant will allow for the integration of the Balancer protocol into dHEDGE allowing managers to trade and utilize Balancer pools.

dHEDGE V2 and Developer updates

Follow the roadmap and features requests at https://dhedge.canny.io/

Uber pool renamed to Protocol Treasury

Latest Audit for new contracts underway with Certik

AAVE integration ready to be deployed once Audit is finalized and changes addressed

New assets FRAX and FXS available now

dHEDGE Stablecoin yield pool(dUSD) now farming USDC-FRAX with +21%APY

Quickswap and 1inch protocols currently internal testing

Currently market making via bots on OKEx

Working on in app notification system - deposits, withdrawal, new pool posts and replies

Performance mining V2 in production

Manager bot service now available - utilize trading view signals

Testing ongoing for replacing WalletConnect management with SDK

Media

Manager Spotlight

Interesting Tweets

Job openings

Upcoming Events

Twitter spaces event hosted by dHEDGE DAO - more details soon!